Percentage of taxes taken out of paycheck

These taxes are deducted from your paycheck in fixed percentages. How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you might.

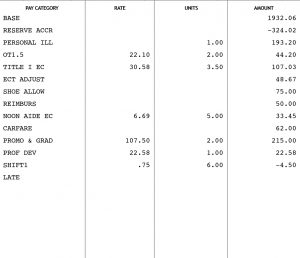

Understanding Your Paycheck

Ad Simplify Upgrade Enjoy Easy Payroll Tailored To Your Needs.

. Was about 346 for a single individual in 2020. What is the average amount of taxes taken out of a paycheck. These are contributions that you make before any taxes are withheld from your paycheck.

What percentage of federal taxes is taken out of paycheck for 2020. Ad Get the Paycheck Tools your competitors are already using - Start Now. Also Know how much in taxes is taken out of my paycheck.

FICA taxes are commonly called the payroll tax. Discover Helpful Information And Resources On Taxes From AARP. The federal income tax has seven tax rates for 2020.

How You Can Affect Your Michigan Paycheck. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Your employer will withhold 145 of your wages for Medicare taxes each pay period and 62 in Social Security taxes.

How Your North Carolina Paycheck Works. Amount taken out of an average biweekly paycheck. Your 2021 Tax Bracket To See Whats Been Adjusted.

Amount taken out of an. Census Bureau Number of cities that have local income taxes. Total income taxes paid.

The average tax wedge in the US. Ad Compare Your 2022 Tax Bracket vs. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

What percentage of federal taxes is taken out of paycheck for 2020. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W. For example in the tax.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. For a single filer the first 9875 you earn is taxed at 10. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62.

The tax withholding rate on supplemental wages is a. The tax wedge isnt. Federal income taxes are paid in tiers.

However they dont include all taxes related to payroll. The employer portion is 15 percent and the. Choose From the Best Paycheck Companies Tailored To Your Needs.

Another option to increase the size of your Ohio paycheck is to seek supplemental wages such as commissions overtime bonus pay etc. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. 10 percent 12 percent 22 percent 24 percent 32 percent 35.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. How do I calculate taxes from paycheck. FICA taxes consist of Social Security and Medicare taxes.

4 rows The withholding tables have tax brackets of 10 percent 12 percent 22 percent 24. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. 10 percent 12 percent 22 percent 24 percent 32.

Choose Your Paycheck Tools from the Premier Resource for Businesses. The federal government receives 124 of an employees income each pay period for Social Security. Census Bureau Number of cities that have local income taxes.

You pay the tax on only the first 147000 of your. For example if your gross pay is 4000 and your. How Your Oklahoma Paycheck.

Both employee and employer shares in paying these taxes. Your employer matches your Medicare and Social Security contributions. Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. North Carolina income tax rate. The federal income tax has seven tax rates for 2020.

Oklahoma income tax rate.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Online For Per Pay Period Create W 4

Taxes On Paycheck On Sale 52 Off Www Ingeniovirtual Com

My First Job Or Part Time Work Department Of Taxation

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Taxes On Paycheck Hotsell 50 Off Www Ingeniovirtual Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

How To Calculate Taxes On Paycheck Hotsell 50 Off Www Ingeniovirtual Com

Paychecks Payroll

What Are Payroll Deductions Article

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Check Your Paycheck News Congressman Daniel Webster

Taxes On Paycheck On Sale 52 Off Www Ingeniovirtual Com

Understanding Your Paycheck Credit Com

Irs New Tax Withholding Tables

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2